Back in the early 1980s, MacKay & Company began profiling the aftermarket replacement parts used on Class 6 – 8 trucks, school buses and trailers in the United States. Since that time, 40 years more or less, MacKay & Company has expanded the scope of its research to include additional geographical areas such as Canada, Mexico and Brazil, distribution channels (dealer, heavy-duty distributors, buying groups and others) and vehicles (construction, agriculture, vocational and light duty). The company refers to this aftermarket service as “DataMac.” The foundation of all DataMac products is data obtained through survey work with owners and maintainers of commercial vehicles — those individuals with boots on the ground who address parts replacement and service activities.

In 2014, the company expanded its DataMac service to include transit buses and motorcoaches, generating the initial Transit Bus and Motor Coach Operator Report. With the initial study serving as the baseline, MacKay & Company released its second iteration of the transit bus and motorcoach aftermarket report last year and included highlights of the findings from the 2019 Transit Bus and Motor Coach Operator Report.

Populations

In developing United States and Canadian populations of transit buses and motorcoaches for the study, estimates were developed by combining the current survey data with published population information from the American Bus Association Foundation (ABAF): Motorcoach Census 2015 and the American Public Transportation Association: 2017 Public Transportation Fact Book, Washington, D.C., March 2018.

North American motorcoach carriers have experienced consolidation over the reported 2013-2015 timeframe according to ABAF Motocoach Census data. The number of carriers declined 10 percent to 3,200 while the number of operating motorcoaches increased six percent to 38,700. In the U.S. and Canada, 80 percent of motorcoach carriers are operating an average of four coaches while the largest carriers (accounting for one percent of the total carrier population) have 640 coaches in operation. In the company’s estimation, motorcoaches in operation total 39,000. Through the analysis of transit agencies data as reported in the Public Transportation Fact Book and the survey data, the company estimates transit bus population to equate to 85,000 units.

Summary and Key Observations

Many motorcoach transportation service providers offer multiple services to their customers. Among seven types of motorcoach transportation service providers were operating in 2018, it was estimated that 93 percent provided charter service, 41 percent serve packaged tours, 28 percent operated airport transit routes and scheduled transit service was provided by 22 percent of operators. Sightseeing service was also 22 percent of motorcoach business activity followed by special operations and commuter service at 15 percent and nine percent, respectively.

Most transit buses were operated in large metropolitan areas as municipal service enterprises. Among the 50 largest North American transit bus agencies in 2018, the top 10 agencies provided approximately 60 percent of all unlinked passenger trips that comprise 52 percent of passenger miles.

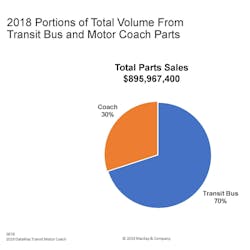

The total estimated value of transit bus and motorcoach service parts demand in the United States and Canada during 2018 was $897 million. Of that total, 70 percent was transit bus parts and 30 percent was for motorcoach repairs. In these vehicle categories, power generation, power transmission and undercarriage parts comprised the largest portions of parts demand at 84 percent of transit bus and 80 percent of coach requirements. Approximately 90 percent of all transit and motorcoach service was performed by fleet shop personnel.

Transit bus and motorcoach operator survey responses in 2018 revealed that three quarters of replacement parts and components installed were purchased new, and another 15 percent to 18 percent were remanufactured purchases. The potential cost of transit service interruption or stranding of motorcoach passengers in remote locations far outweighs any potential savings associated with installation of anything but new replacement parts. Shifting to the distribution of transit bus and motorcoach parts sales by channel again reveals concentration of large portions of volume among four types of retail sellers, heavy duty distributors, engine distributors, manufacturer direct sales and bus dealers. Eighty-three percent of transit bus parts retail demand was fulfilled by these four channels as motorcoach operators turn to these channels for 77 percent of their parts supply.

In the 2018 survey of operators, MacKay & Company asked transit bus respondents what portions of their current fleet vehicles were powered by diesel fuel, natural gas and electric batteries, as well as the portions of these power types they expected to employ five years in the future. Among these responding fleets, 48 percent of their buses presently had diesel power, 26 percent used compressed natural gas engines, four percent were powered by electric/diesel hybrid systems and two percent had electric/battery power. These respondents projected five-year declines of 10 percentage points in diesel engines and a three-point drop in hybrid power as electric-battery-powered units gain four percentage points and compressed natural gas gains five points. With state and federal incentives to operate alternative fuel vehicles, the decline in diesel operated transit buses will likely continue to accelerate.

Components Surveyed

Among the 176 serviced vehicle components covered in the 2018 survey of transit bus and motorcoach operators, those belonging to the power generation (engines and related engine parts) and the undercarriage (steering, brakes, suspension and wheels) product groups respectively accounted for one-half and one-quarter of the $897 million estimated value of all 2018 component purchases.

Reported engine components fall into four categories (internal, external, repair/maintenance and emissions). Internal, external and emission components are sourced mainly through engine distributors while half the total retail value of repair and maintenance parts, such as filters, belts and hoses, are procured from heavy-duty distributors. Fleet shops performed at least 94 percent of repair and maintenance engine components.

The six reported classes of undercarriage components are power steering and front-end parts, air brake, hydraulic brake, suspension springs and shocks, wheels and hubs, and wheel seals and bearings. Together, air brake parts and suspension parts accounted for 60 percent of all undercarriage component sales volume during 2018. Anti-lock brake system components (ABS controller, modulator valve and wheel speed sensor), service and repair was performed in fleet shops in 95 percent of failures with nearly all failed units replaced with brand new ones. Ninety percent of these replacement unit purchases were spread equally among bus dealers, heavy-duty distributors and manufacturer direct suppliers. Among front and rear springs, spring hangers and shock absorbers, three-quarters of all repairs were performed in fleet shops and nearly all air bag replacements were completed in-house.

Power transmission and electrical components equaled eight percent of total transit and motorcoach retail demand during 2018. The lion’s share of power transmission component replacements is associated with complete automatic transmissions, but automated manual transmission demand is beginning to emerge as those units reach replacement mileage.

Replacement batteries totaled half of all electrical component demand value in 2018. Starters and alternators contributed a third of electrical component sales and lights another fifth of the total. While 60 percent of all batteries, alternators and starters were retailed by heavy-duty distributors and directly from manufacturers, about 65 percent of headlights and signal lights were purchased by end users from heavy-duty distributors, bus dealers and auto parts stores in 2018.

MacKay & Company has an abundance of data points on the transit and motorcoach replacement parts market, and believe it or not, there is even more to know.

------------------------------------------------------------------

Molly MacKay Zacker | Vice President of Operations

Molly MacKay Zacker is vice president of operations of MacKay & Company. In this capacity, she coordinates many behind the scenes activities, manages the research department, authors and edits reports and presentations, conducts research and collaborates with other team members on single and multi-client projects.