New MTI Research Finds California Could Lose $100B in Transportation Revenue by 2040 if Voters Repeal Senate Bill 1

The future of California’s landmark Senate Bill 1 (SB1) -- the Road Repair and Accountability Act of 2017 — will be decided at the polls on November 6. Proposition 6 asks voters to choose whether or not to repeal the SB1. But what would be the financial consequence of repealing SB1?

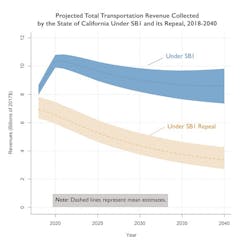

A new report by the Mineta Transportation Institute at San José State University explores this very question. The study projects that, between now and 2040, California will lose approximately $100 billion in transportation revenue if voters repeal SB1. As an example, in 2040, the mean projection is that the state will collect $8.6 billion with SB1 and $3.4 billion without, a $5.2 billion difference. This has significant consequences for the state’s ability to maintain roads, bridges, and address other transportation improvements.

“California’s ability to plan and deliver an excellent transportation system depends upon the state having a stable, predictable, and adequate revenue stream,” said Martin Wachs, lead author for the report. “Californians have an important decision to make on November 6. A decades-long transportation funding crisis left California’s roads badly in need of costly repair and replacement. Without SB1, where will those funds come from?”

The report’s authors – Martin Wachs, Hannah King, and Asha Weinstein Agrawal – project the amount of transportation revenue that the state’s own taxes will raise through 2040 to support transportation services and infrastructure under two scenarios:

- Projected revenue streams under current state laws, including provisions adopted in SB1.

- Projected revenue streams should SB1 be repealed by voters in the November 2018 referendum, Proposition 6, on the state ballot.

In addition to projecting total revenues that California will collect under both scenarios, the authors project the cost to Californians who drive by estimating revenue paid per registered vehicle. With SB1 in place, the average revenue collected per vehicle will increase from $265 in 2018 to a maximum of $310 in 2020, and then fall to $190 per vehicle by 2040. Should SB1 be repealed, mean projected revenue per vehicle will drop every year, falling to about $74 in 2040.

The report also reviews the history of raising transportation revenue in California and documents public opinion about different transportation revenue options based on evidence from voting outcomes and public opinion research.

“Whether SB1 is repealed or retained by voters in November 2018, transportation revenue will decrease over time due to inflation and, most importantly, because of dramatic increases in fuel efficiency and the widespread adoption of zero emission vehicles,” notes study co-author Hannah King. “Of clear importance to the public is assurance that the revenue is being spent efficiently and on things that they care about such as maintenance, safety improvement, and programs that benefit the environment.”