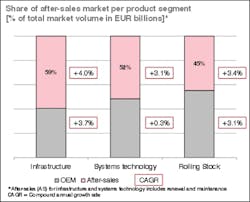

Coinciding with InnoTrans, SCI Verkehr presented its new study "The Worldwide Market for Railway Technology 2012." According to the study, the worldwide market volume for railway technology products and services currently totals around EUR 143 billion, after some very good years. Up to 2016, the overall market will continue to grow at a rate of 3.3 percent per year (including price development) to almost EUR 168 billion. Following a further rise in delivery volumes up to 2013, SCI Verkehr expects a stagnation in new business altogether in the next five years. The market volume is almost exclusively generated by the growing after-sales market and the multitude of new metro projects, especially in Asia.

The catastrophic environmental and transport situation in many cities in Asia and South America, combined with often poorly developed transport infrastructure, leads to steady growth in urban transport in the long term. In these regions, rail transport can bring its advantages over other transport modes into play, i.e. high passenger capacities and high speeds.

Market development differs considerably between the transport segments. "The time for expensive, prestigious projects with few transport benefits is over," said Maria Leenen, CEO of SCI Verkehr GmbH. Given the public budget deficits, expensive high-speed trains and lines are being recalculated, postponed or even entirely abandoned. Instead, many national governments are opting to upgrade conventional networks to improve profitable freight services. The industrial partners in such projects and procurements are often Chinese or local manufacturers and not the technological leaders from Europe and Japan. "Accordingly, we expect to see a consolidation among manufacturers of advanced railway technology. The structures in terms of costs, locations and make-or-buy decisions are going to be critically reviewed across the entire sector and presumably readjusted in many cases due to the growing price pressure and competition. We expect this sector restructuring to give rise to new industrial partnerships – perhaps surprising ones from today's perspective – and specialists who have hardly been known before now."

The long-term growth drivers suggest further growth in the railway technology market. Ongoing urbanization, ambitious climate goals, the continuous rise in demand for resources (and the associated development of new raw material deposits) and increasing global trade lead to a positive outlook. The main challenge for the railway technology industry in the future will be to consistently defend the position of the most eco-friendly transport mode. The durability of the products compared to motorised private transport is an obstacle. Because of very complex licensing hurdles, the European railway industry, the market leader up to now, is at a serious competitive disadvantage. "More innovations can be tested in Asia or in road transport – Europe's railway technology is at risk of being left behind," Leenen said.