Increasing Demand for Multiple Units Worldwide – Leading Market Europe with Considerable Growth Despite Crisis Stmosphere

The global multiple unit market defies all crises and will grow by a good 4 percent per year up to 2017.

In its latest MultiClient Study "Diesel Multiple Units/Electric Multiple Units – Global Market Trends" SCI Verkehr GmbH shows that mainly Western Europe as the strongest market has recently had an underestimated potential to some extent despite the major orders in the last few years. More than ever before, Germany will invite tenders for a vast number of regional and commuter transport services in the coming years. The U.K. has restructured its franchise programme and demand is still high even after the awarding of the Thameslink contract based on electrifications plans. In Asia, the market will become more important since conventional railway will shift into the focus following years of investments in high-speed lines. While the market for electric multiple units is significantly increasing in almost all regions of the world, SCI Verkehr expects declining market volumes in the diesel multiple unit market, particularly in the leading market of Europe.

The worldwide market volume for electric and diesel multiple units amounts to just short of €15 billion. With a share of more than 80 percent, electric multiple units present the more important business segment. The markets for OEM and after-sales business are approximately on the same level. There are almost 32 000 electric multiple units and 13 700 diesel multiple units in operation worldwide. The largest fleets are operated in Japan, Germany, U.K. and France. Average age of the installed base is 19 years with wide regional differences. The substitution of locomotive-hauled trains with passenger coaches by modern multiple units has not yet been completed throughout the world. Since 2004, railway passenger transport has seen a sharp increase only interrupted by a short drop in 2009 due to the economic crisis. As a result of increasing transport demand on the one hand and infrastructure upgrades on the other, the demand for multiple units will also grow. Necessary procurements to replace old fleets mainly provide momentum for new procurements in Africa, Eastern Europe, the CIS and South America.

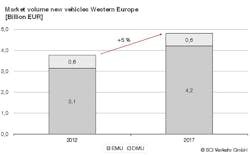

Western Europe is the most important target for multiple units with a share of 50 percent in the worldwide market. The major national markets have so far made it through the economic and Euro crisis unscathed and provide new impetus for future growth. In Germany, the award volume for rail passenger transport services will achieve a record high by 2017. The tenders for major networks in North Rhine-Westphalia and Baden-Württemberg as well as commuter rail systems in Hamburg and Berlin promise that vehicle manufacturers will be awarded further major contracts. Before the end of 2013, the Régiolis and Régio2N will be delivered in France, which SNCF had procured from Alstom and Bombardier as part of framework contracts for up to 1 800 units.

Because of the restructuring of the franchise programme and the implementation of planned electrifications, the electric multiple unit market will also grow in the U.K. following several weaker years. In Southern Europe, on the other hand, procurements will decline further due to economic problems.

The smaller market for diesel multiple units will stagnate in the next five years as the current high market volumes will decrease in Eastern and Western Europe. The weak transport growth on secondary lines and planned electrifications have a dampening effect on procurements. Starting from a low level, other selected markets will grow considerably. Main drivers are the replacement of old vehicles and the upgrade of commuter networks. New vehicles in Asia or the CIS will become more expensive in the future because of the usage of foreign components to increase quality. A trend towards hybrid and battery technology is appearing in Japan and will become important throughout the world in the medium to long term.

Most important manufacturers are Bombardier, Stadler, Alstom as well as Japanese companies. Although most manufacturers are still very active in their domestic regions, deliveries to other regions have increased. There is a trend towards co-locating production. For example, Siemens and Stadler are currently establishing new plants in the CIS. SCI Verkehr is observing a clear increase of maintenance contracts for manufacturers in the after-sales market.

The market study "Diesel Multiple Units/Electric Multiple Units – Global Market Trends" is available in German from July and in English from August 2013 at SCI Verkehr GmbH.