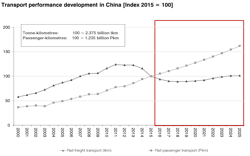

While the Chinese rail passenger transport performance has been steadily increasing since 2003, the rail freight segment is currently suffering from slowing economic growth, intermodal competition and especially crisis in the steel and iron sector as well as decreasing developments in the coal sector: These negative developments lead to very low procurement volumes for freight wagons and locomotives. China Railway has reported a decline in rail freight of 13.7% of the total transport volume in 2015, measured in tkm. This is the largest ever recorded annual decline in rail freight. SCI Verkehr does not expect medium-term recovery of the freight market and forecasts strong decreasing new procurements both for electric and diesel locomotives over next five years. New procurement of freight wagons will remain at a level far below the years 2011-2013. Challenged by overcapacity, Chinese industrial players have to restructure and focus on international business to balance slowing developments in the home country.

The Chinese railway technology market has reached a current volume of more EUR 30 billion, and will continue to grow by c. 2% per year. The globally most important railway market will mainly benefit from a growing after-sales market, but its OEM market will record a negative development (-0.9%), mainly influenced by the decreasing activity in the very high-speed segment. The rail freight segment is under pressure due to slowing economic growth and decreasing developments in industrial sectors steel, iron and coal.

Continuing growth in the urban rail, suburban rail and intercity high-speed railway ensures high overall market volumes.

In the past 10 years, China has developed into the largest and one of the most dynamic rail markets in the world. There have been massive investments in the rail sector, especially in high-speed systems. Investments reached an enormous peak in 2010 of EUR 120 billion. Since then, investments for rail technology in China have been reducing, but have overall remained noticeably above the 2008 level. Whereas in previous years investments were primarily in very high-speed and long-distance passenger rail transport, China’s investments in the coming five years will focus on intercity high-speed lines, regional passenger rail and urban transport. While the rail passenger transport performance is steadily increasing, the rail freight segment is suffering from slowing economic growth.

The after-sales market in China is growing especially fast and gaining importance against OEM products due to the massive fleet and network expansion. Rolling stock is especially important and makes up 70% of the total after-sales market. Heavy maintenance for rolling stock is generally carried out by the rolling stock manufacturer CRRC. Challenged by decreasing OEM procurements and respectively overcapacity, increasing after-sales volumes will generate new business for CRRC. But China Railway also plans to strengthen its own heavy maintenance capabilities, especially in the high-speed train segment. As European operators, it can be expected that China Railway will do more after-sales services in house, instead of to contract it to third parties, to reduce costs and increase own capacity utilization. Thus means Chinese manufacturers cannot benefit fully from the increasing after-sales market, but have to focus on international business to balance slowing developments in the home country.