New Study: Railway Electrification Continues to Grow in 2018

The current market volume is c. EUR 10 billion ($12.38 billion), and will grow with a CAGR of 3-4 percent per year up to 2022. This reflects the trend towards electric mobility in rail transport and the gradual turning away from diesel power. In particular, this market growth is generated by a large number of metro projects as well as intensified electrification of existing diesel lines with growing operational demands. The European market is once again growing especially dynamically. Momentum for the market development up to 2022 will come from the realization of projects in France and Spain which have been partially delayed due to the debt crisis as well as from electrification of diesel lines in Eastern European countries and Scandinavia. The Asian market also continues to grow. China is continuing to invest large sums in electric rail lines.

A major influence on the market volume for electrification comes from projects to construct new lines or upgrading existing ones. Such changes to the existing network are always subject to political interests and decisions. This makes infrastructure policy a fundamental driver of the market.

Although rail electrification is a niche market within rail infrastructure, it is a growth market with long-term positive prospects, as there are economic and environmental advantages to electrical operation compared to diesel. Of around 1.3 million km of rail lines worldwide, around 344,000 km are electrified, i.e. just over a quarter. In individual market regions, the degree of electrification varies from 1 percent (North America) to 57 percent (Western Europe). The degree of electrification in Asia has risen substantially in the last few years. In 2013 it was still 34 percent, but by 2017 it had reached 47 percent. Besides China’s large investments in both constructing new lines and electrifying diesel lines, India has also been an engine for growth.

Historically, various electrical systems have developed in individual countries and regions. Their specific structural configurations are even more significantly varied than is shown by an overview of the power systems used. In the field of railway electrification, this has led to the establishment of medium-sized national markets with many regional suppliers familiar with the relevant national requirements and standards. The industry structure is very advantageous for niche suppliers.

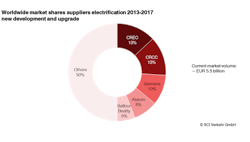

Among the small number of international suppliers in the field of rail electrification are Siemens, Alstom and Balfour Beatty. While Balfour Beatty sold its rail divisions in many countries as part of a restructuring strategy in 2012-2014, the possible merger of Siemens and Alstom might lead to the emergence of a new world market leader which would be bigger than the two Chinese rail construction groups CREC and CRCC.

These are among the results of the new market study “Railway Electrification — Global Market Development” produced by SCI Verkehr GmbH, the international consultancy firm specialized in railway technology and logistics.