Germany: Growth Dynamic in Control Command and Signalling of the Rail is Weakening

Consulting company SCI Verkehr GmbH expects a noticeable decline in growth dynamic in its current study entitled “Control Command and Signalling – Global Market Trends.”

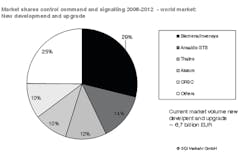

The current market volume for control command and signalling totals around €14 billion (€6.7 billion for new development and upgrade) at present and will grow at an average of only 2 to 3 percent p.a. up to 2017.

This most important reasons for this development are the deficits of the public budgets mainly in China and large parts of Europe which will lead to stop of expenditures and reductions of investments for these infrastructure measures relevant for safety. Whereas urban rail transport systems will show strong growth in this segment in the medium term, the volume for new development and upgrade of high-speed lines will decrease. According to estimations by SCI Verkehr market experts, the global system providers for control command and signalling are about to see a consolidation process: In early 2012, Siemens made already the start by taking over the railway automation segment Invensys Rail.

Control command and signalling represents the high-tech segment of infrastructure. Besides vehicle technology, it is at the peak of technological development in the field of rail transport. Sufficient investments in control command and signalling are of crucial importance for the transport mode rail. The pressure to act on network operators comes from increasing transport performances over the long term and growing requirements to make operations efficient and safe. The key drivers for installing or upgrading control command and signalling systems are:

• Higher requirements for safe railway operation

• Technical and economic handling of increasingly complex railway networks

• Increasing the efficiency of transport junctions and systems

• Increasing demand for transport performance

• Failures and frequent problems of existing control command and signalling technology

• Financial resources and possibilities of state infrastructure operators to finance new development and upgrade projects

• New product offerings from industry with extended usage potential

• Cost reductions over the entire life cycle

Even under the impact of the financial problems of the public budget in many countries (particularly in Europe), the markets for control command and signalling are seeing a slow but steady upward trend.

The total market volume currently amounts to around €14 billion. Maintenance and renewal make up just more than half of the market volume. As in all markets for infrastructure the ongoing requirement for replacements determines the market volume within the existing networks.

The market for new development and upgrade will grow moderately at a CAGR of 2.2 percent per year up to 2017. Whereas the emerging markets of Africa/Middle East, South and North America and the CIS will see disproportional growth, low CAGRs in Asia will dampen the total growth. Asia’s markets for control command and signalling will stagnate in the medium term as the market volume in China is currently at a very high level and will decline in the medium term.

The global players Siemens/Invensys, Thales, Ansaldo STS, Alstom and Bombardier are dominating the market. Japanese suppliers also have high-quality control command and signalling technology but are far less successful on the world market than the international suppliers. The state-owned Chinese company CRSC has achieved a considerable market share in the last five years which is based on a high domestic demand. Since control command and signalling technology varies considerably depending on region and country for historical reasons, there are numerous midsized companies, which have been established in their domestic countries for a long time. Niche suppliers have an important market position within various product markets.