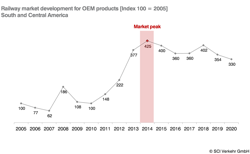

Railway Market in South and Central America: Recent Peak and Economic Crises to Reduce Market Volume

The South and Central American market for new railway technology has been growing strongly in the past years. In 2015, it registered sales four times higher than in 2005. The growth trend, however, reached a peak level in 2014 and declined by 5.8% in 2015. Future perspectives are more negative: influenced by the exceptionally high level of the period between 2010 and 2014 and the deceleration of economic growth in the region, the market for railway technology is expected to register an overall reduction of 0.6% p.a. between 2015 and 2020.

These figures of the overall market include after sales services, which are expected to continue growing at a rate of 3.1% p.a. thanks to recent infrastructure expansions and fleet growth. Excluding the after sales market, the market for railway technology (OEM) will face an even more challenging situation with an expected annual average growth rate of -3.5% p.a. This differentiation is important because the majority of after sales services is provided by internal resources of rail operators and, thus, is not part of the actual market.

Numerous rail projects have recently been concluded or are in the final phase of implementation, such as the North-South Railway in Brazil, the renovation of the Argentinian EMU fleet or the construction of a metro system in Panama. The simultaneous implementation of many projects drives up demand for railway technology but their concomitant conclusion negatively affects the market development, especially in the relatively small markets of South and Central America. Development and implementation of new projects depend not only on political will and technical capacities, but also on the availability of funds, which were already becoming more restrictive due to the high number of projects in execution.

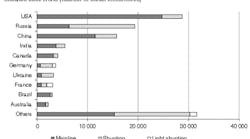

Additionally, the regional economy has not been performing as well as expected since 2015. Brazil, by far the largest market for railway technology in the region, registered a 2.8% decrease in GDP. More than the reduction of economic activity, the current crisis will have a more negative influence on the railway technology market through financing. Most new – and even renewal – projects are financed directly or indirectly with state support: many urban rail operators are state-owned or state-controlled and even private freight rail operators depend on fiscal incentives and subsidized interest rates to invest.

Due to the fiscal crisis in Brazil, governments have prioritized projects already in execution at the cost of others that were in the initial stages of planning or execution. This prioritization contributes to weaker decline in the short term – and also to an earlier finalization of the project than if all projects were being executed at a slower pace. However, the absence of projects in initial stages, especially between 2015 and 2016 – will have a negative impact on the market in the medium-term, when projects should be maturing and under implementation.

Nevertheless, the region will continue to implement a number of interesting and important rail infrastructure projects. These can be found in detail in the new MultiClient Study http://www.sci.de/en/products/scimulticlient-studies/search-result/study, available on April 26th 2016 in English from SCI Verkehr GmbH.